University of York

We supported Foresight Group on the acquisition of two on-campus student accommodation assets at the University of York.

Danish PPP Portfolio Acquisition

We acted as exclusive financial advisor to International Public Partnerships (INPP) on the acquisition of four PPP projects in Denmark.

MCS Acquisition

We provided model audit advice to Infracapital on the acquisition of Multimodal Container Services B.V. (“MCS”), one of the Netherlands’ largest container logistics companies.

HEDNO Privatisation

We provided model audit advice to Macquarie (MIRA) on acquiring a 49% stake in the Hellenic Electricity Distribution Network Operator (HEDNO).

Northumbrian Water Investment

We provided model audit advice to KKR on their successful acquisition of a 25% minority stake in Northumbrian Water

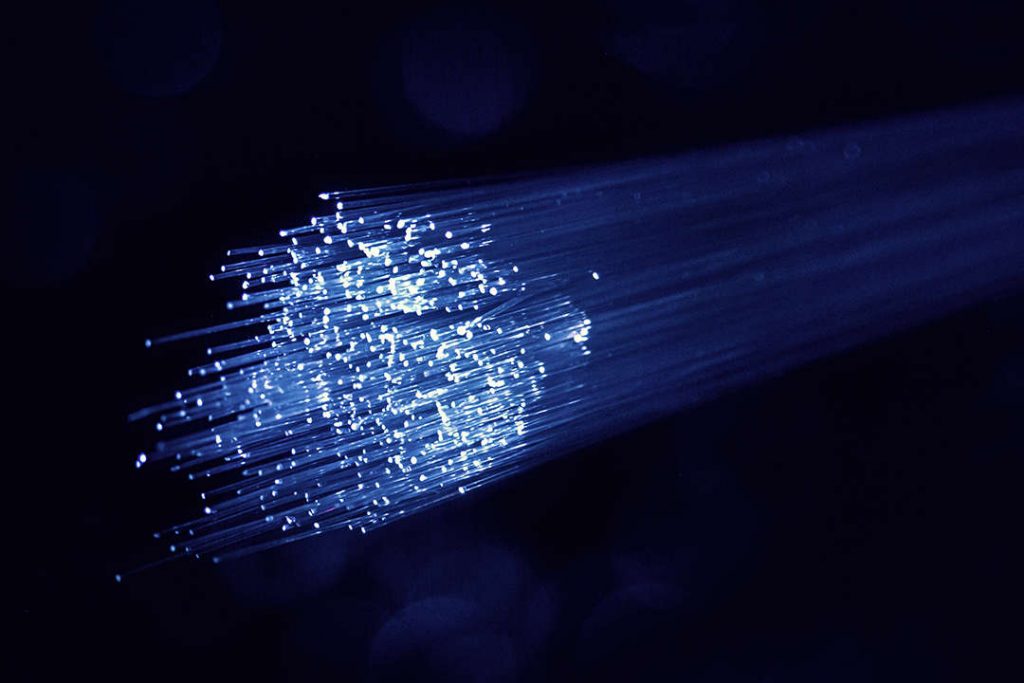

SiFi Networks’ FibreCity

We provided model audit advice to Whitehelm Capital on their investment into SiFi Networks to enable the developer to expand into more US cities.

Ottoway Portfolio Acquisition

EvoInfra acted as financial advisor to DIF Capital Partners on its investment in eight UK Purpose Built Student Accommodation (PBSA) assets, totalling 4,500 beds.

Recharge Bolt-On Acquisition

EvoInfra provided model audit advice to Infracapital on the bolt-on acquisitions to their existing EV charging platform, Recharge.

DBE Energy Acquisition

EvoInfra acted as financial advisor to Lazard Asset Management on the acquisition of DBE Energy

Asanti Edge Acquisition

EvoInfra acted as financial advisor to Invesis on its acquisition of a 100% stake in UK-based Asanti Datacentres