Introduction

Battery Energy Storage Systems (“BESS”) provide an optimal solution to renewable energy intermittency by storing excess generation during periods of low demand or low pricing and exporting during periods of high demand or higher pricing (often referred to as revenue shifting). BESS can also play a crucial role in counteracting renewables curtailment – i.e. where there is excess generation and/or grid constraints, restricting a renewable energy project’s ability to export. As such, BESS continues to establish itself as an increasingly important asset class in the UK’s energy system.

BESS financings share many similarities with those of other renewable energy generation assets with high capital requirements and long asset lives. However, unlike traditional renewables projects which can secure Contracts for Difference (“CfD”) each year under Allocation Rounds, there are no government-backed revenue support mechanisms in place for battery storage in the UK as standalone projects. Equally, long-term contracted revenues (i.e. Capacity Market revenue) have historically been a relatively minor component of the revenue stack, with the complexity of multiple revenue streams and the nature of the technology (degradation and future augmentation) also important factors.

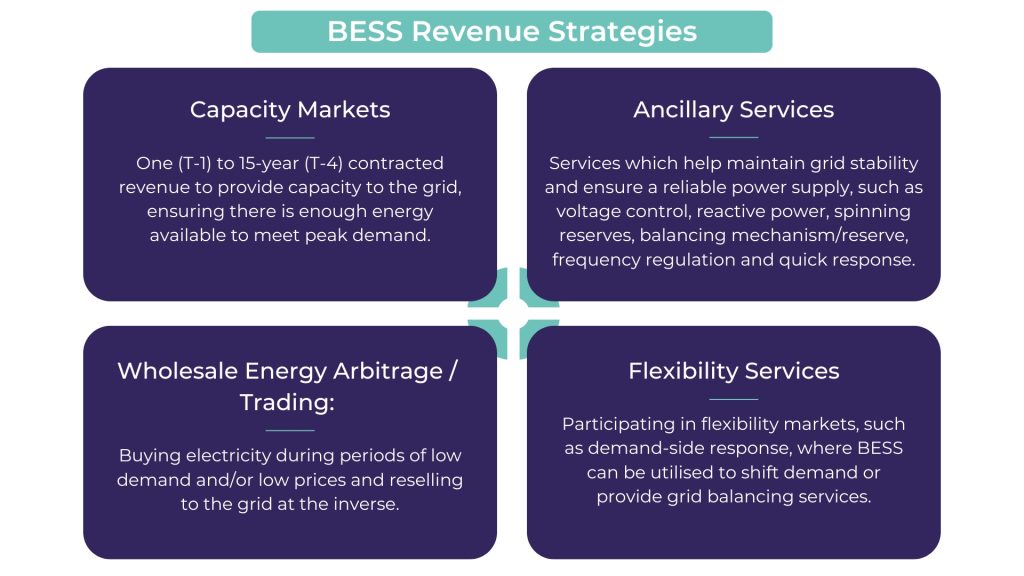

Each revenue strategy is inherently unique, and synergistic, to the operations of other renewable energy technologies, consisting of:

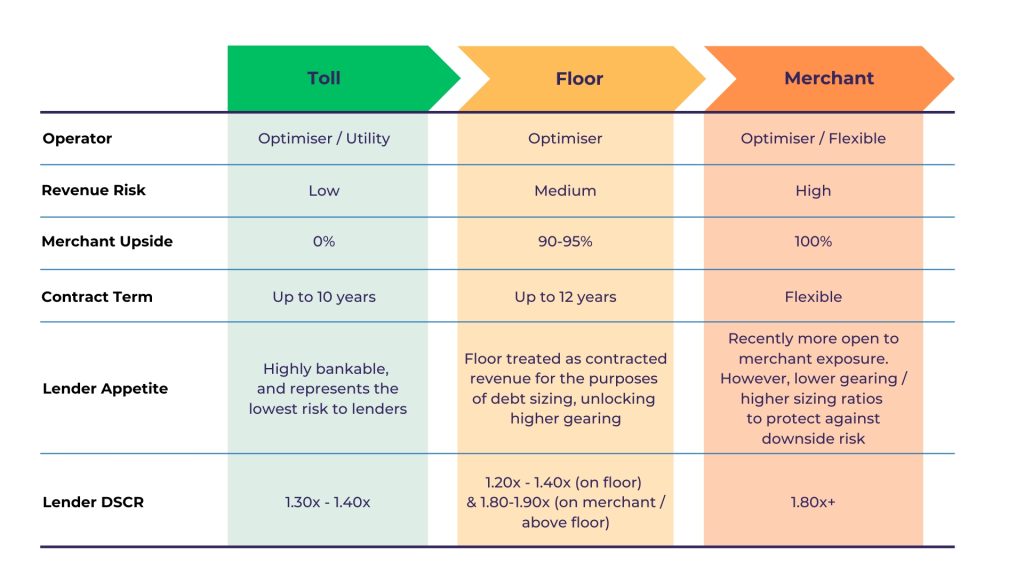

Typically, BESS assets are managed under long-term ‘optimisation agreements’ with ‘aggregators’ or ‘optimisers’, who will operate the asset on behalf of the asset owner and aim to maximise available revenue. These can be structured under fully merchant, floor, or tolling contracts, depending on the risk tolerance of the investor/asset owner. Depending on the chosen agreement, the optimiser can underwrite all, or a portion of the revenue, providing the contractual certainty of income streams required by lenders.

A floor or tolling contract, combined with a T-4 capacity market contract, creates a strong base of contracted cashflows on which to raise project finance.

Where there is the underpinning of a floor (and/or toll), the lender will naturally place high scrutiny on the track record and credit-worthiness of the optimiser. Should circumstances require, there are insurance products and alternative credit solutions which can be used to underwrite minimum revenue levels, which are deemed as bankable alternatives to traditional optimiser floors, and could allow for more flexible trading strategies. Procurement of your preferred optimiser should consider different options into their sensitivities and selection process.

BESS cashflows depends on its capacity and its ability to discharge that capacity when required. Therefore, built capacity (to grid connection) and duration strategy are important. Equally, performance warranties with original equipment manufacturers (“OEMs”) are central to risk management. Warranties are typically offered to cover degradation, round-trip-efficiency and availability, through a Long Term Services Agreement (“LTSA”).

It’s typical, from an equity viewpoint, to assume the project will be “repowered” midway through its life by replacing the BESS containers. The cost of doing so at this point isn’t known, nor is the revenue potential, therefore, this typically can’t be included in a lender base case, and the original batteries must be able to operate, and their performance guaranteed, for the entire tenor of the loan.

Lithium-ion batteries dominate today’s BESS market, but they come with recognised drawbacks. For example, degradation, fire risk, and increasing cost/asset-life challenges for storage durations of 8+ hours. Several alternative long-duration technologies (LDES) are now emerging, but with fewer fully commercial, project-finance-closed installations to date than lithium-ion, their risk profiles remain less established.

Despite this, lenders have become increasingly confident with a range of business cases, including those with merchant revenue exposure, with an increasing number of financings reaching financial close year-on-year, with 2025 hitting new highs in debt finance deployed.

For co-located projects (i.e. BESS and solar PV) there are different considerations for debt financing, which we will cover in a follow-on piece.

Lenders will want to see that the Engineering, Procurement and Construction (EPC) contractors and OEM are reputable and have the ability to honour the performance warranties they provide. Early engagement with EPC contractors and manufacturers helps to ensure a smooth transaction process. In light of ongoing grid reform (at the time of writing), it’s crucial to understand and be able to demonstrate your grid connection timeline. We suggest engaging with an ICP and / or grid advisor to ensure your connection is protected and progressing as required.

For further information on grid reform and how to position your BESS project in the market, please see our recent whitepaper.

The goal of any financing should be to increase the value of the asset to its owners. Using a high level of debt is one way to achieve this. However, it should be weighed against trade-offs in the revenue stack, which can erode value. For example, a toll will allow the project to borrow higher levels of debt, at the cost of merchant upside during the tolling contract.

Equity investors and sponsors should carefully consider what type of asset they want to own. Whether a highly contracted infrastructure asset, a merchant trading-based asset, or somewhere in the middle. That should drive decisions around project structuring, rather than simply achieving high levels of gearing.

If you would like to discuss anything we covered in this article, or to discuss BESS and project financing more broadly, then please contact us here. We’d love to hear from you.