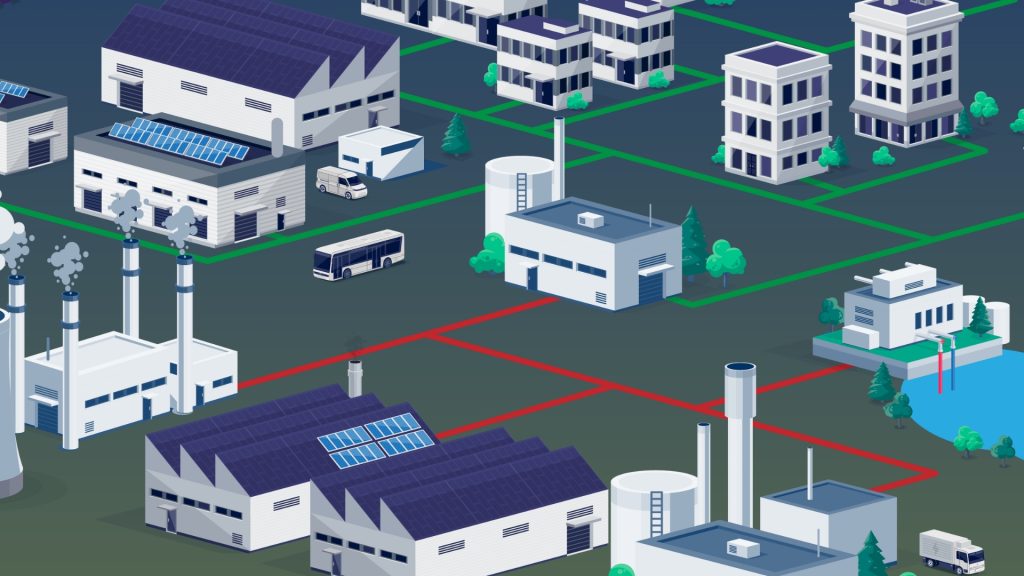

Ambition to Action: Heat Networks in 2025 and Beyond

2024 saw ambition finally being met with action, from significant investment into innovative and large-scale projects, policy development and enhanced consumer protections – laying strong foundations for further progress in 2025 and beyond.